Why Health Plan Networks Matter

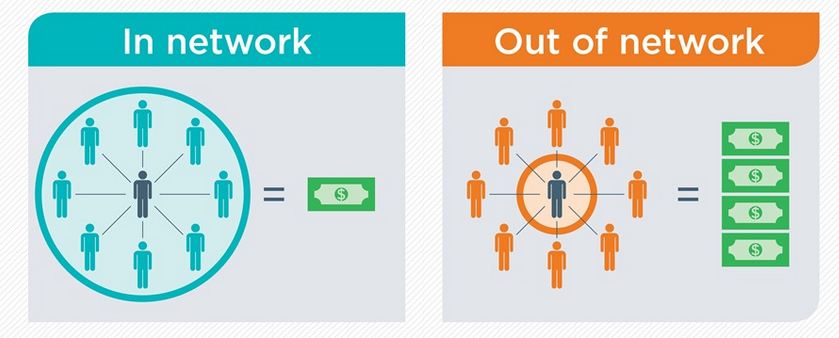

When it comes to the cost of health care, whether a health provider is in-network matters. Whether your health insurance plan is an HMO, PPO, POS or other network type also may affect your cost for care. What can you do to minimize surprises in health care costs? First, know what type of network your […]

Why Health Plan Networks Matter Read More »