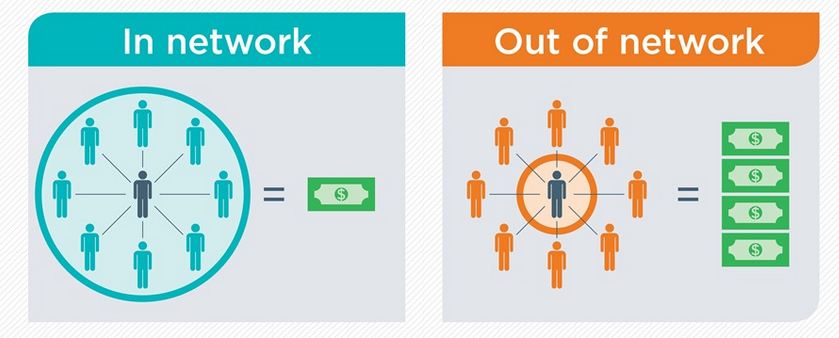

When it comes to the cost of health care, whether a health provider is in-network matters. Whether your health insurance plan is an HMO, PPO, POS or other network type also may affect your cost for care. What can you do to minimize surprises in health care costs?

First, know what type of network your health plan uses. Always check if the doctor, clinic, hospital or other facility is in-network PRIOR to receiving scheduled care. Emergency care is typically billed in-network on most health plans, regardless whether the ER is normally in-network or not. If you have an HMO, or Health Maintenance Organization, then typically only in-network providers are covered for scheduled care. This does NOT necessarily mean that you have a small network or limited access to care. Many HMO networks are large, with a wide variety of providers. Other HMOs may be smaller. Out-of-network care likely has no coverage, which means you pay the full amount of the bill for care you receive. Also, if there is no contracted price out-of-network, the services may be billed at a higher rate than services billed under contract.

Second, if your health plan covers out-of-network care, you need to know HOW it covers those services. A PPO network, or Preferred Provider Organization, typically covers care both in and out-of-network. However, out-of-network care often costs more and has higher maximum out-of-pocket costs. Sometimes you pay 50% of the cost for care rather than a co-pay, and it may be subject to double to out-of-pocket maximum.

Above all, for all scheduled care, we recommend verify coverage, cost estimate, and in-network status PRIOR to receiving care. This minimizes surprises. If you are looking for a health plan that covers out-of-network care well or has a large network of providers to choose from, let us help you shop and compare plans. That’s what we do!